What is Paytm Money?

Paytm Money is a transaction and advisory platform for the investors looking to invest in a mutual fund. Paytm Money is a subsidiary of Paytm.

It is focused on bringing a fully digital investing experience for Mutual Fund investors, that provides maximum benefits to the investors as it offers only direct plans in mutual fund schemes that come with no hidden commissions.

Vision behind Paytm Money was to make Investing and Wealth Management – Simpler, Transparent & Accessible for millions of Indians.

Paytm Money Goals

To make investing and wealth management —

Simpler, Transparent & Accessible for millions of Indians.

– We would achieve this goal by starting wealth management via Direct Mutual Fund Plans.

– Adding next to the product would be Mutual Fund Investment Packs (by Paytm Money Advisory Team).

– NPS (National Pension Scheme)

– Stocks (Trading in live Equity market)

– Merging Paytm Gold into Paytm Money.

My Role

This was a stealth project inside Paytm started in Aug 2017 and I was the 1st designer on the team, and I was working along with Product and Strategy team on creating the first draft of experience for Mutual funds investment.

My first order of business was to understand Mutual fund domain and understand where the current apps in market were failing to meet the users expectation in terms of user experience.

Followed by understanding the users who are going to invest and their behaviours and then designing an experience that would help them invest in mutual funds in a simple and transparent way.

Timeline

14 Months – Aug 2017 to Sep 2018

Understanding the Domain

What are mutual funds?

A Mutual Fund is formed when capital collected by various investors is invested in purchasing company shares, stocks, or bonds. Shared by thousands of investors, mutual funds investments are collectively managed by a professional fund manager to earn the highest possible returns.

– Money pooled from various individuals (investors)

– Professionally Managed

– Higher returns than conventional investing

– Allows to invest in small amounts

– Access to large portfolios

– Well-regulated

Why start with mutual funds?

– The increasing awareness of Mutual Funds, thanks to industry initiatives like AMFI’s (Association of Mutual Funds in India) Mutual Fund Sahi Hai campaign.

– The focus of AMCs on Investor Awareness Programs

– Market Regulator SEBI’s continued efforts towards increasing transparency in this Industry

Competitive and comparative analysis

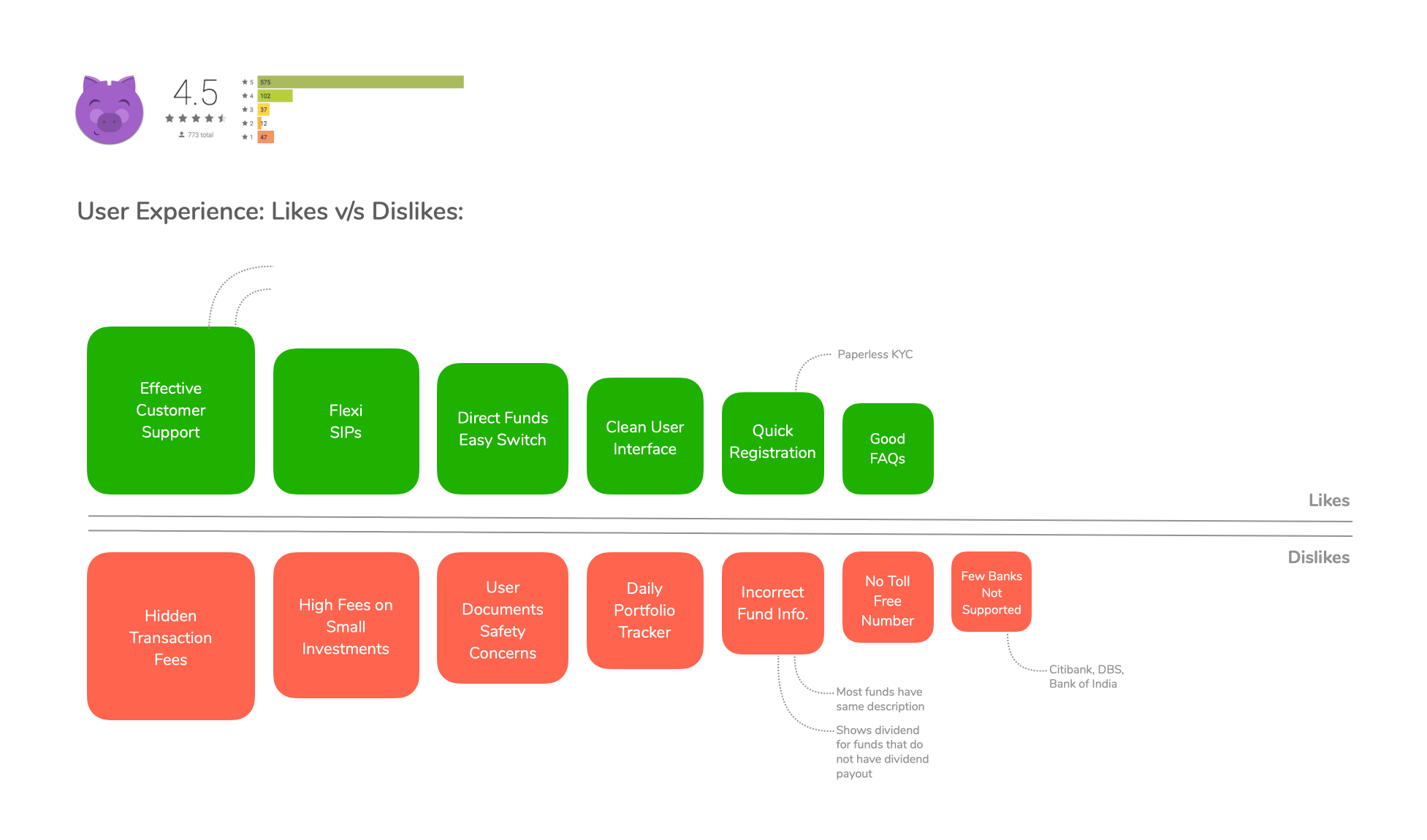

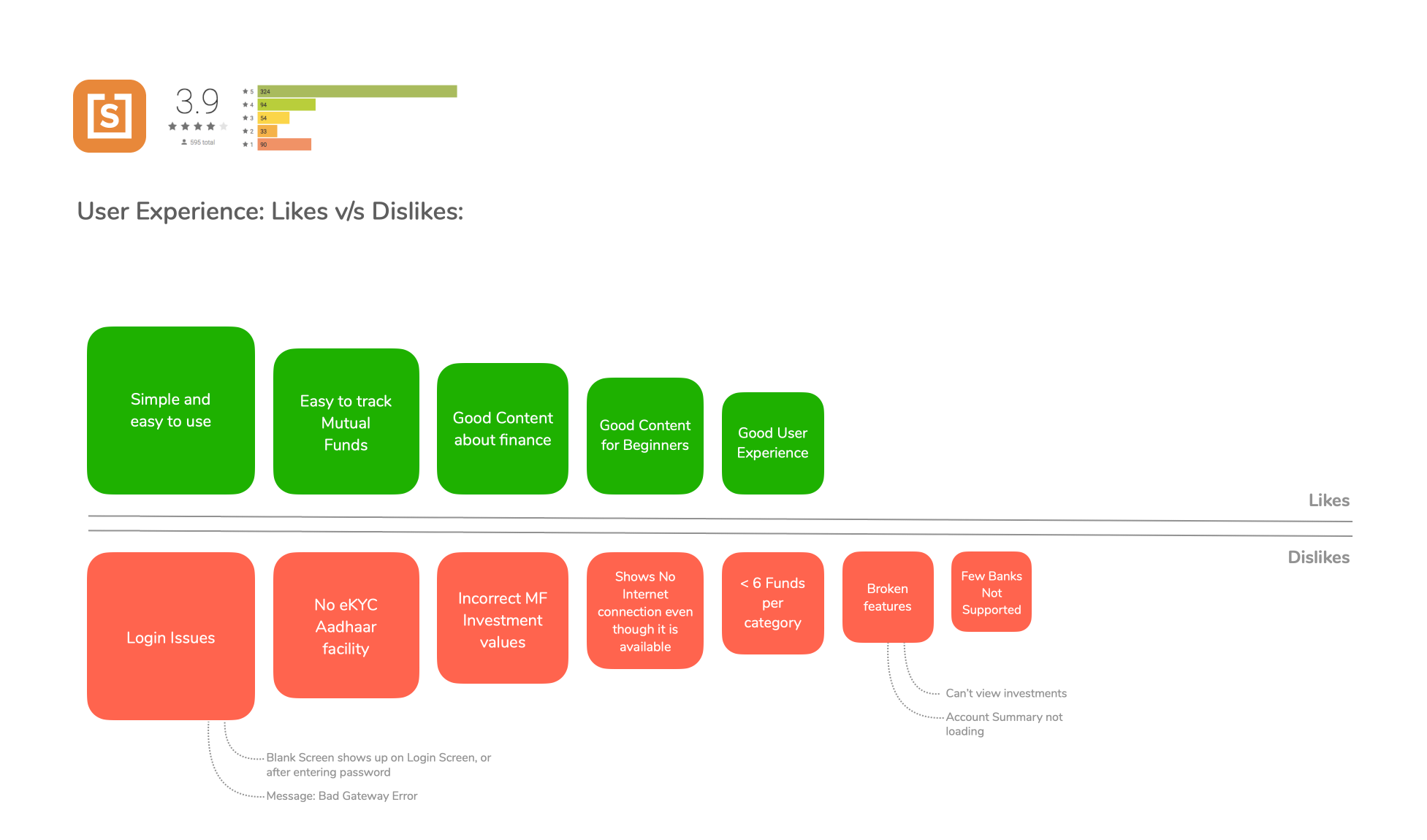

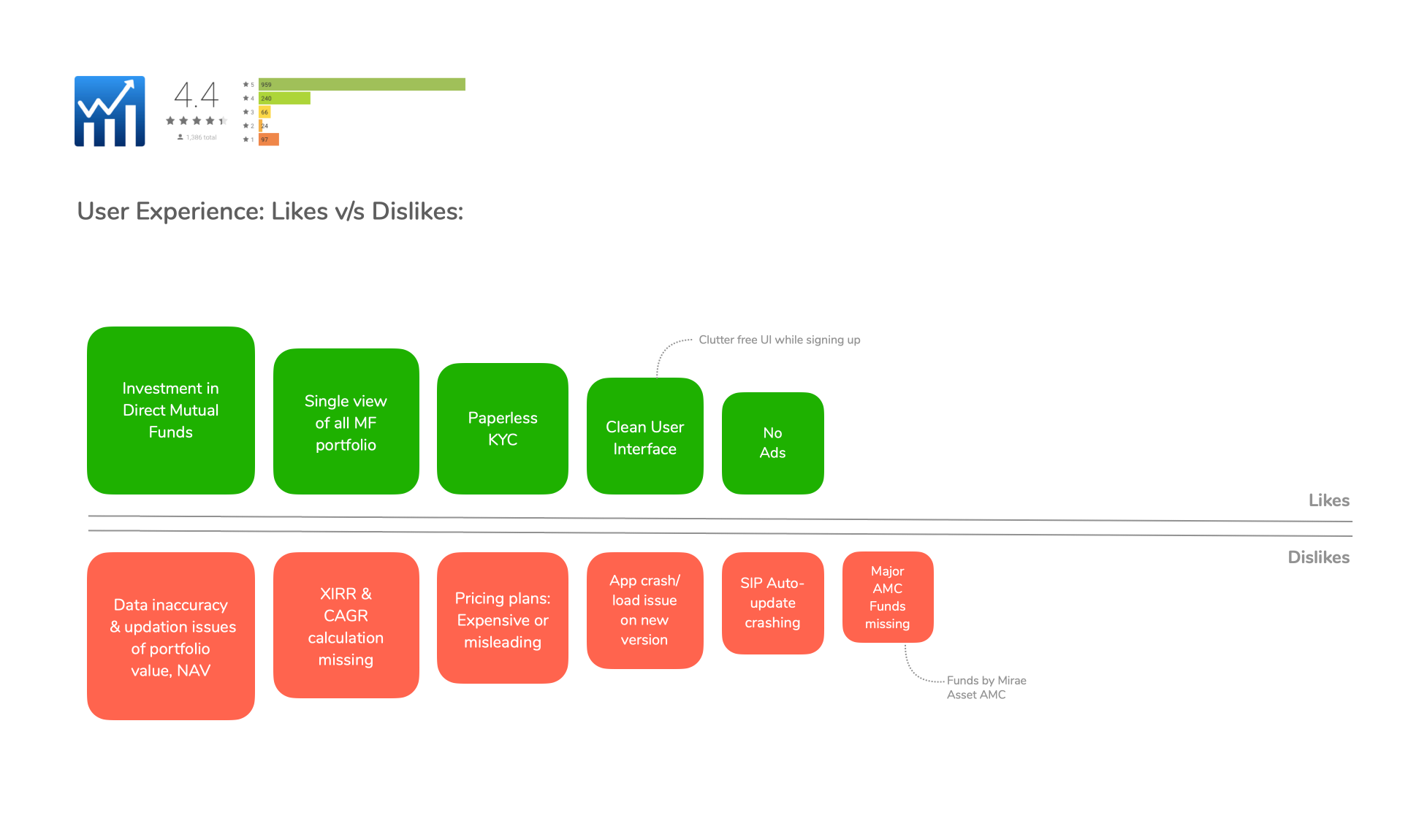

I undertook a comparative study of mutual fund investment apps like Piggy, WealthTrust, Scripbox, Fisdom, Funds India, Motilal Oswal, Coin By Zerodha to identify the Likes and Dislikes of the app feature from customers point of view.

What was my process?

I collaborated with one of the app developer from the team to downloaded the reviews of the app from Google Play Store and Apple App Store, we downloaded around 500-600 review of the app based on the rating and relevancy.

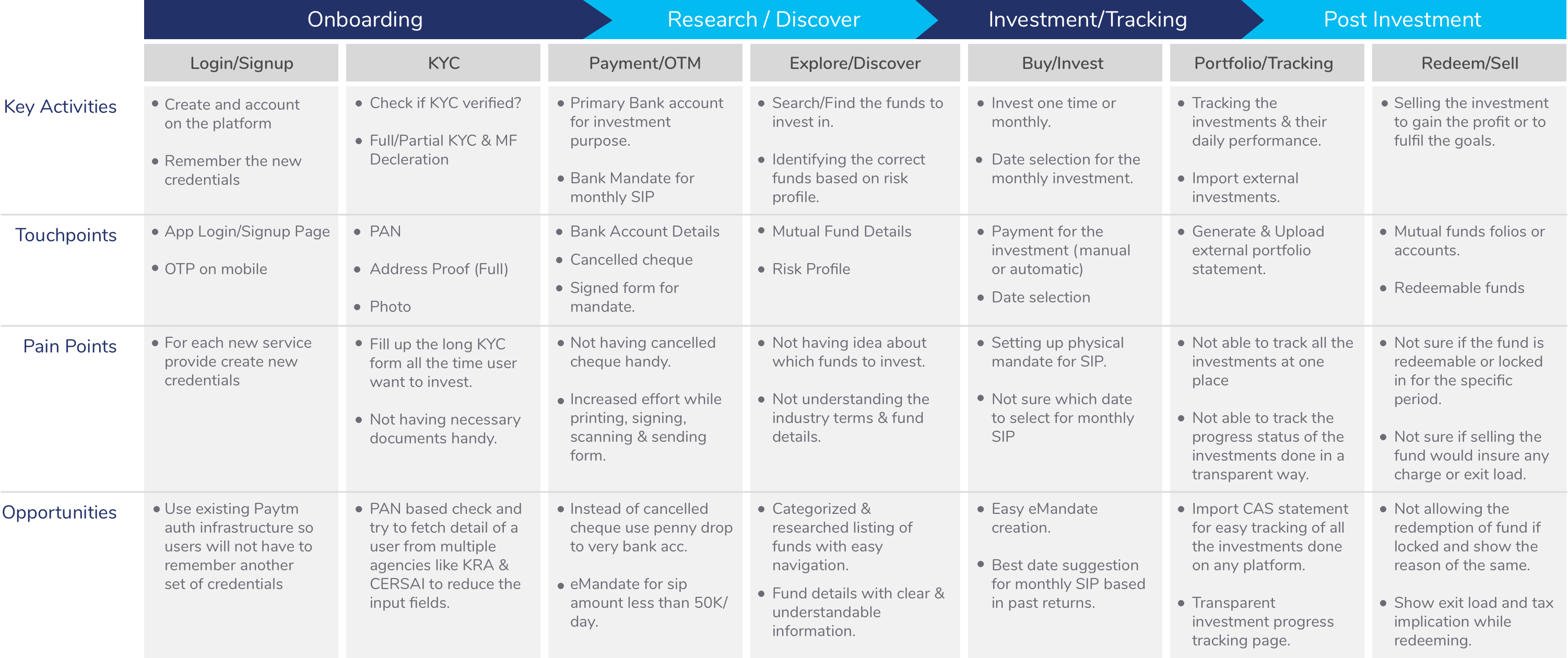

Post that I went through each comments and categorised them into the following user journey

App reviews analysis

What I learnt via competitive & comparative analysis

Typical User Journey

Understanding Users

Investment landscape in India

People around India have been living their ideology of investing their money for small-time investments into community-based chit funds or Fixed Deposits, Recurring Deposits, Public Provident Fund, National Pension System, but mutual funds and stocks still had the risk and loss of money factor attached to them compared to rest of the others and doing it online and awareness of direct mutual funds was almost nil.

There were around 25 million investors who do investment in mutual funds which represents less than 1.5-2% of the population.

When we started working on the mutual fund version of the app the Annual growth rate of mutual fund industry was 15.25%, meaning every year 15.25% of new investors were entering the mutual funds market.

Hurdles while investing in Mutual funds online

The main factors which were affecting users decision for online investment were,

– Ignorance about the domain (mutual funds)

– Lack of Trust & Transparency

– Lack of Guidance

– Complicated Onboarding KYC Process

– Post transaction support

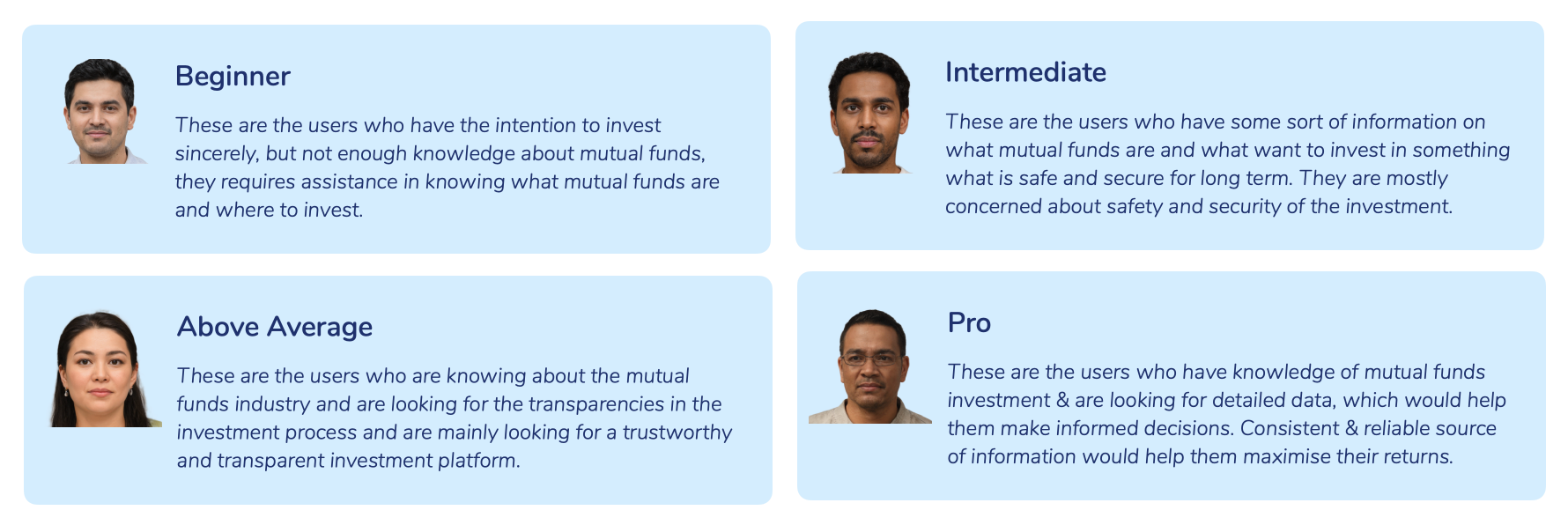

User Personas

While user personas are revealed after a more extensive research, we did some user quick interviews to find out what is the Investing patterns of users in India. Post which we were able to define our 4 types of users who invest in India. We also had to find a way to prioritise their needs while allowing a faster and better way to invest in mutual funds.

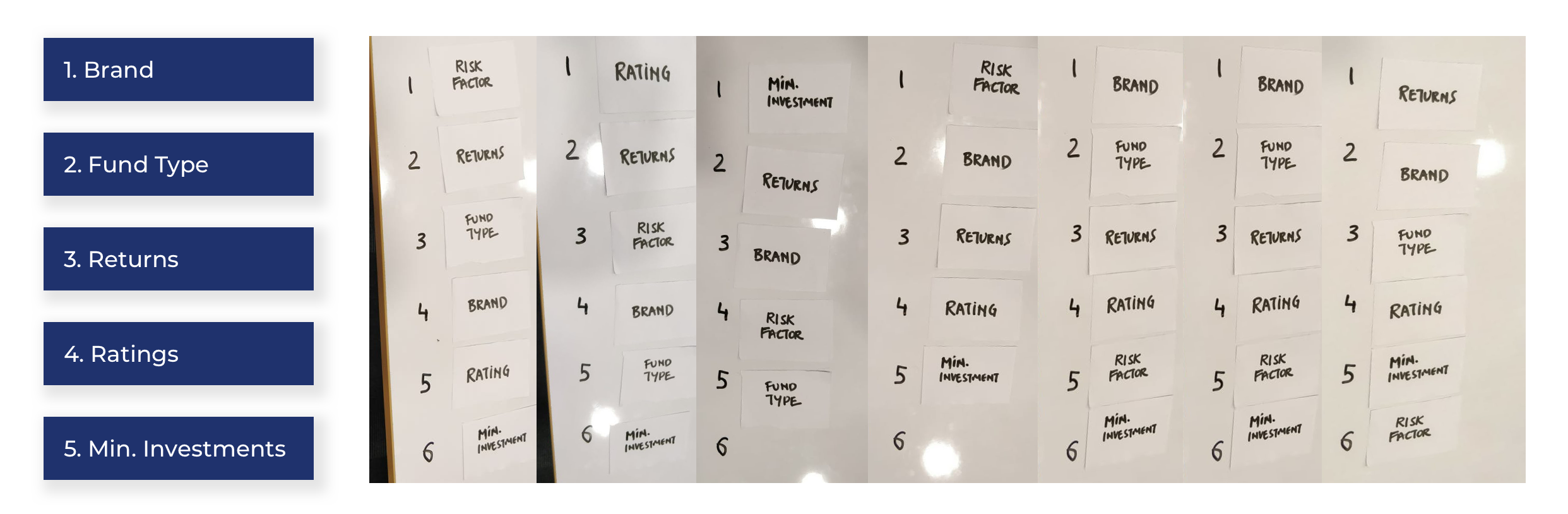

Card Sorting Exercise

I conducted a card sorting exercise to understand users mindset in choosing a mutual fund, the above 4 types of personas were includes from office itself and the sorting was supposed to be done for the following parameters.

1. Fund type

2. Brand

3. Retunds

4. Ratings

5. Minimum Investments

Users were asked to choose the sequence the card based on their decision making factor and collectively I got the following results.

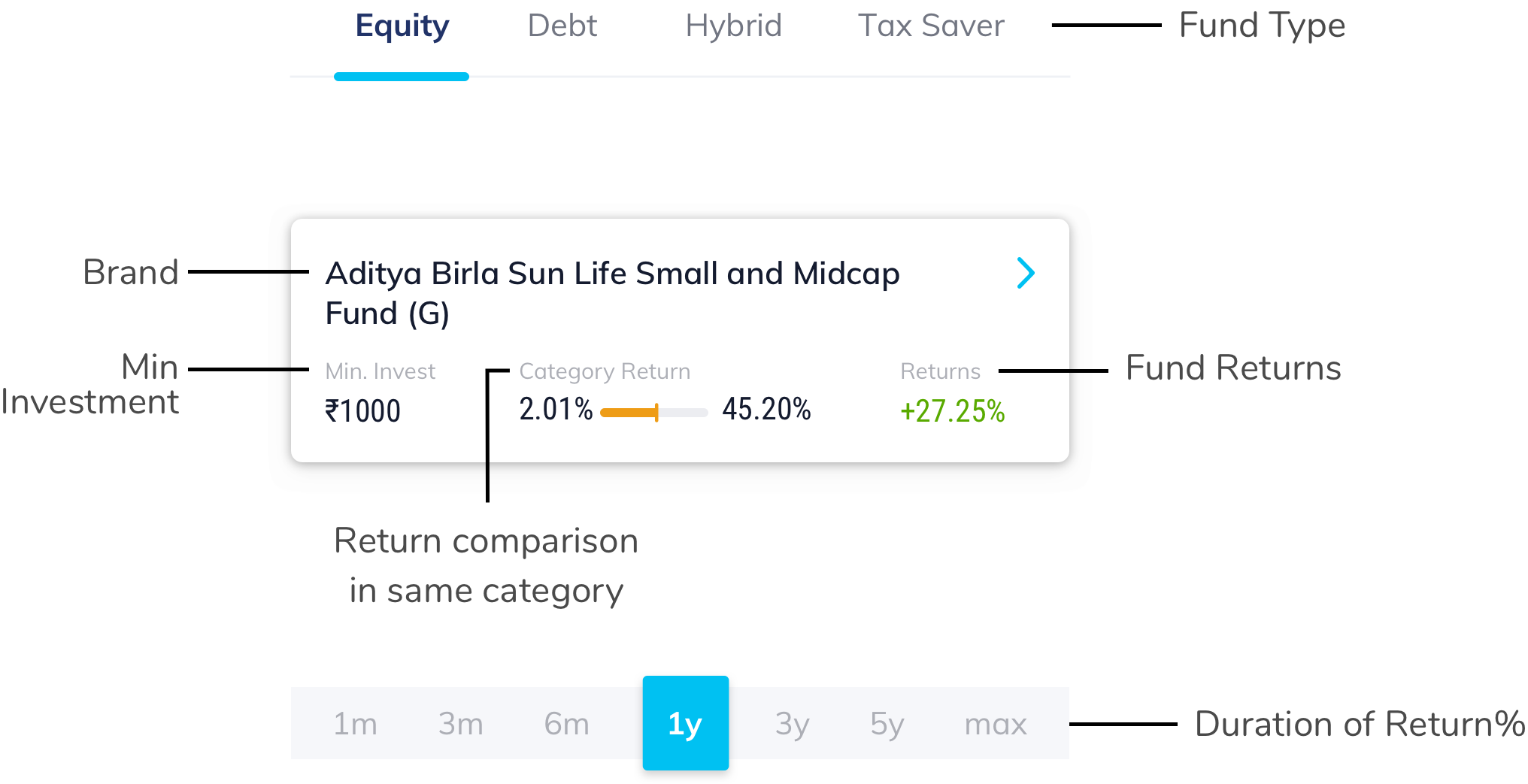

This card sorting exercise help me design the main card which would be used everywhere in the app and would as an entry point to mutual fund details page.

Synthesising my findings

Based on the user personas and the hurdles faced by the users these are the key pointers my app/experience should focus on.

– Easy user onboarding

– Directional Learning (where user learn more about the domain as they explore the app)

– Simple investment and tracking process

– Post investment support and performance tracking

– Easy help available

– Keeping users in loop of each process, to keep the processes transparent

Designing the experience

Defining the application modules

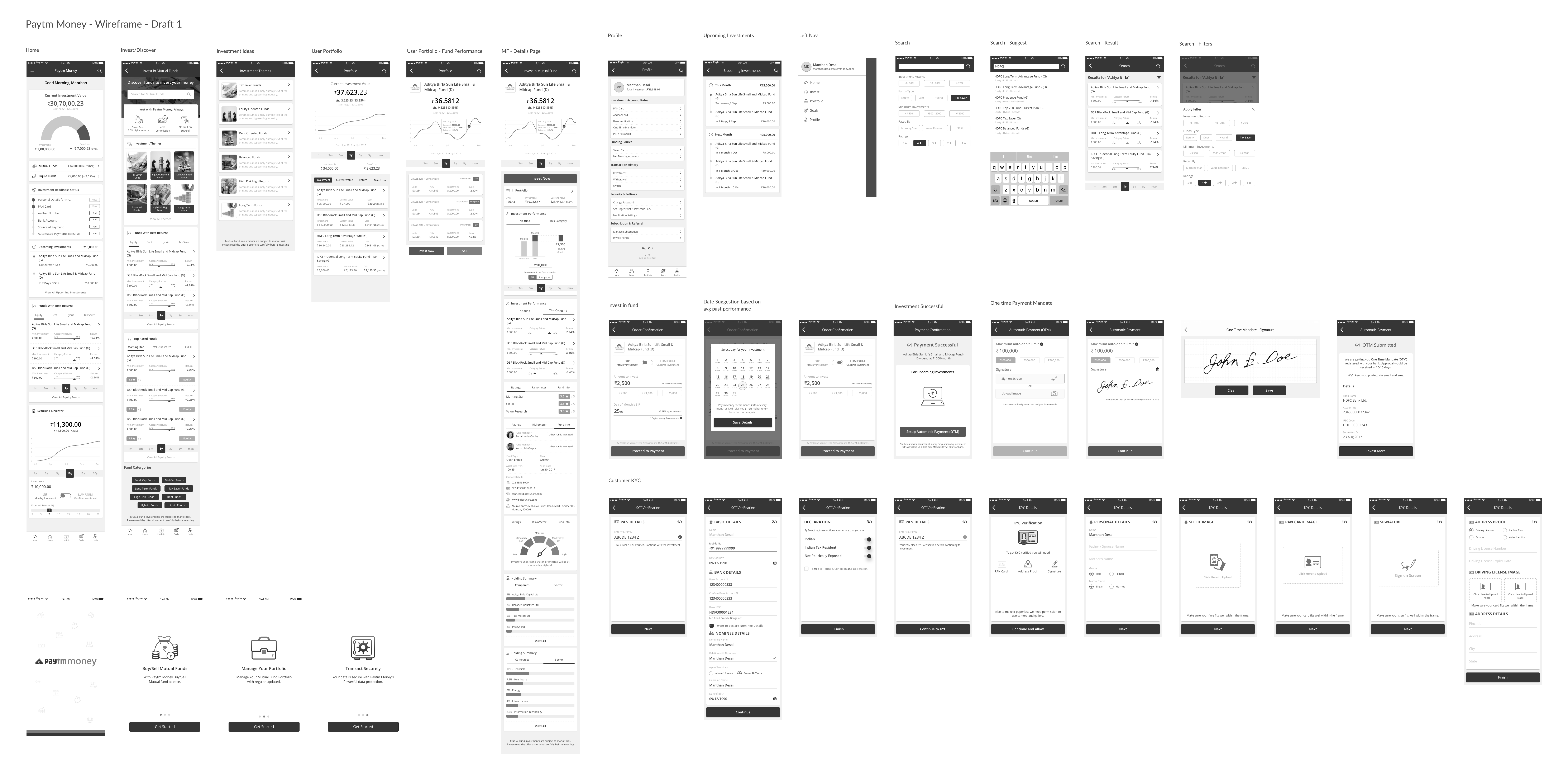

Based on my initial research on what the current market landscape is and what our users are requiring, I created a list of high-level modules/features that we might include and then started working on creating the wireframes for the same.

Onboarding

User KYC – Partial & Full

User Authentication (using Paytm’s infra)

User Risk Profiling

Dynamic Dashboard (Personalised)

Invest/Discover Section – (Research based listing)

Search of funds

Buy/Sell Flow

Portfolio Management

Import External Investments

Statement Generation

User Account Management

Payment Management (Bank/OTM)

SIP Management

Transaction tracking (Current/Historical)

Account Security

Communication Preferences

Goal management

Wishlist

Support Module

Primary Navigation

Wireframes

Home Page

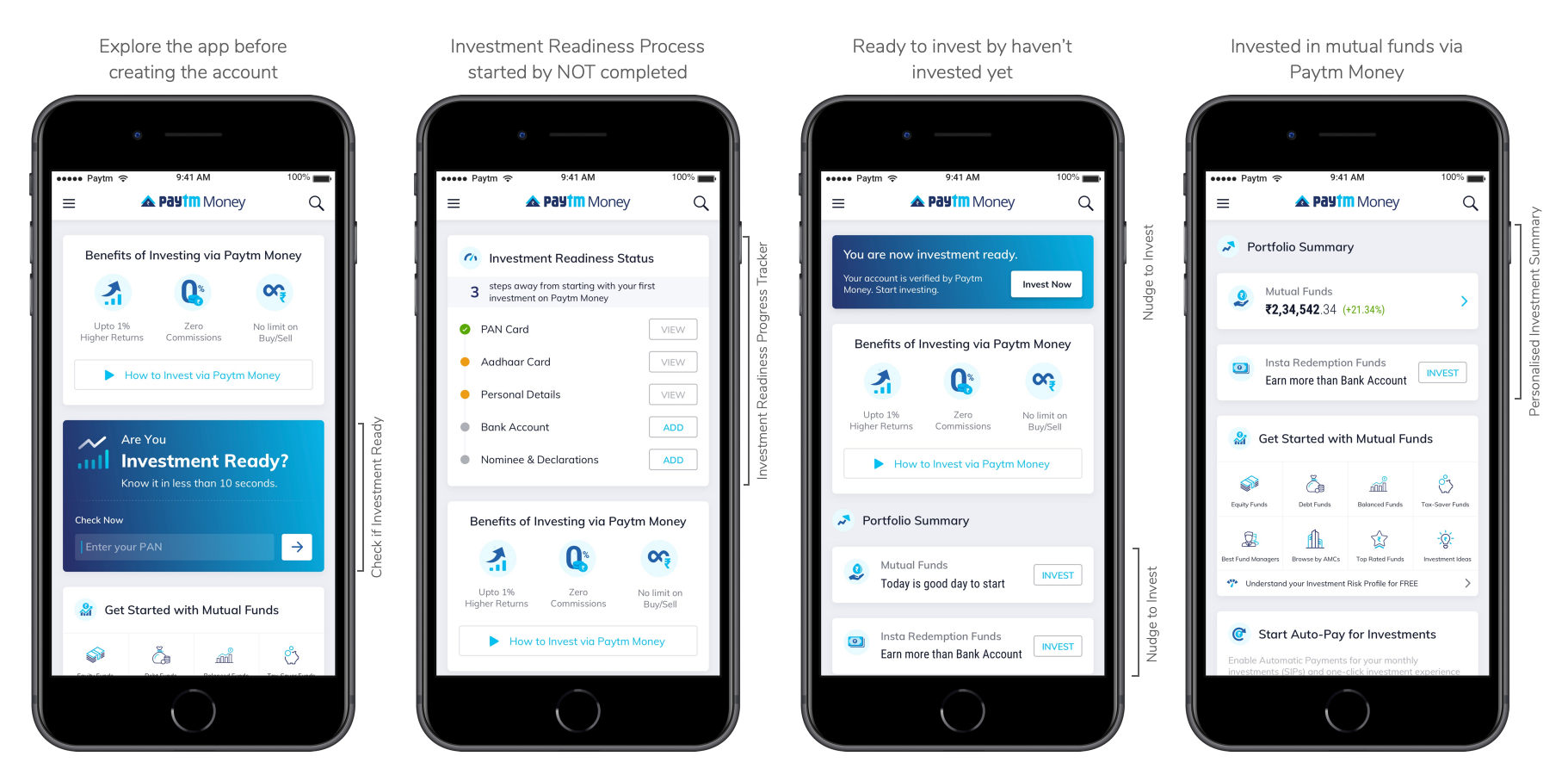

Homepage page was designed to be personalized and targeted to each user type based on their activities and progress.

Invest / Discover

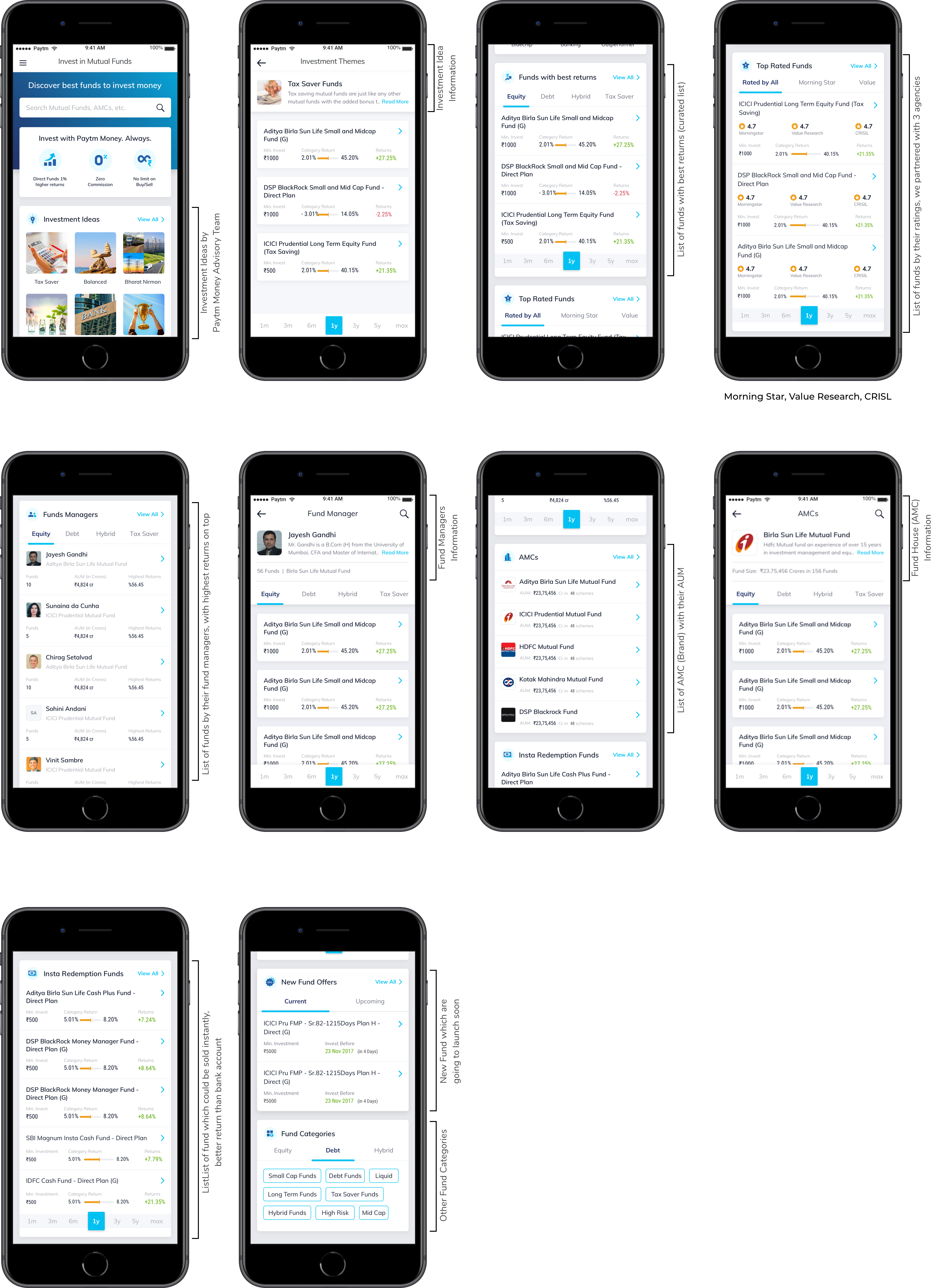

This page is mainly maintained by our research and advisory team and they curate the list of funds based on different categories, returns, risk parameters, fund managers and AMC.

The card sorting exercise that I did help me design a startd fund card layout across the app.

Mutual Fund – Quick Info Card

Invest / Discover Card with different categories and curated list for user to quickly take an investment decision.

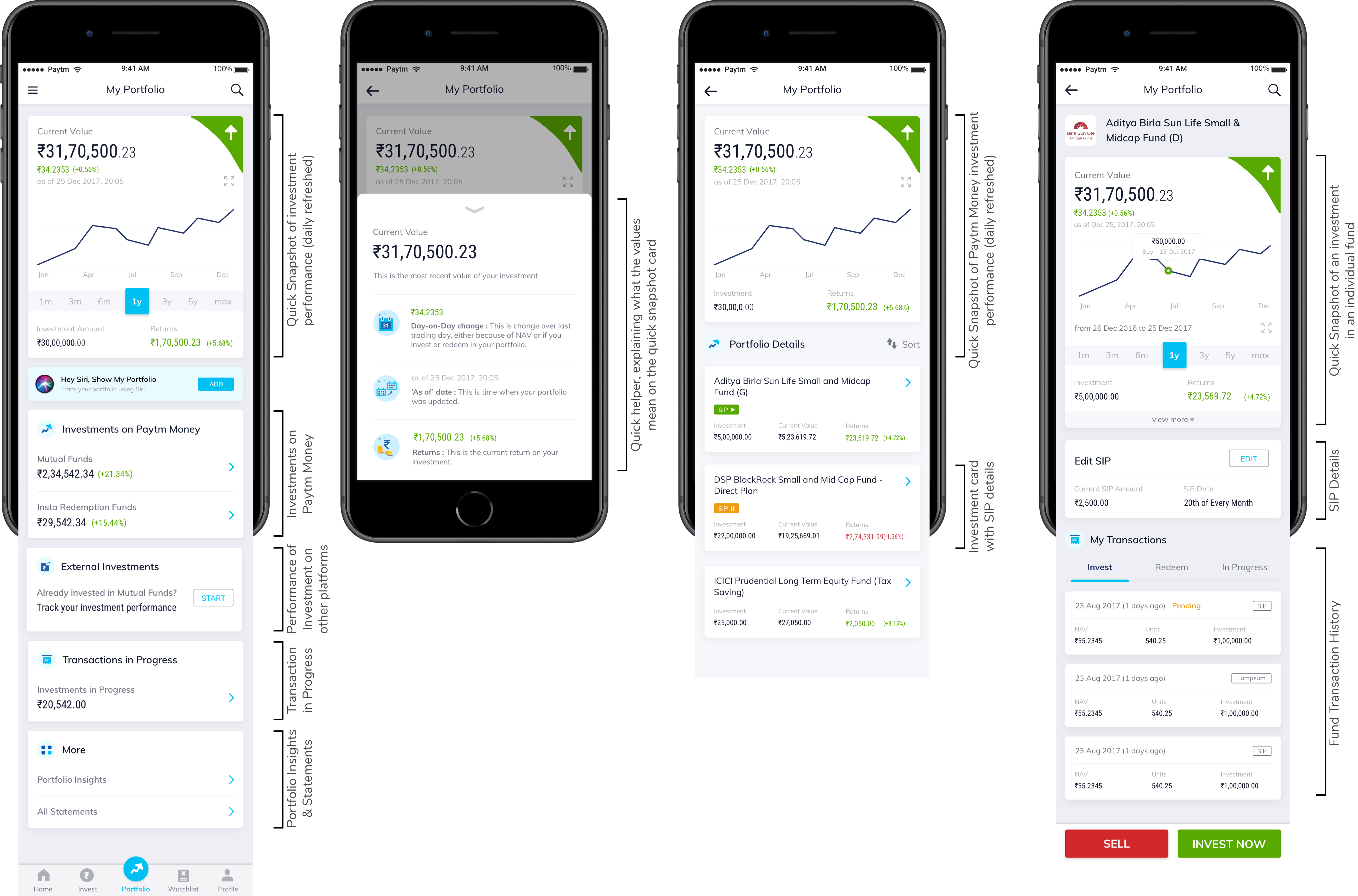

Portfolio

The portfolio page was not just list of investments and would actually give users all the details of their investment and its performance, in the initial idea we just agreed to show paytm money investment portfolio, but then that would not help users track their entire mutual fund portfolio and than later external portfolio was added.

We also wanted to make sure that user can access everything that is related to their investments in a single place like statements, investment insights, transaction history, SIP details.

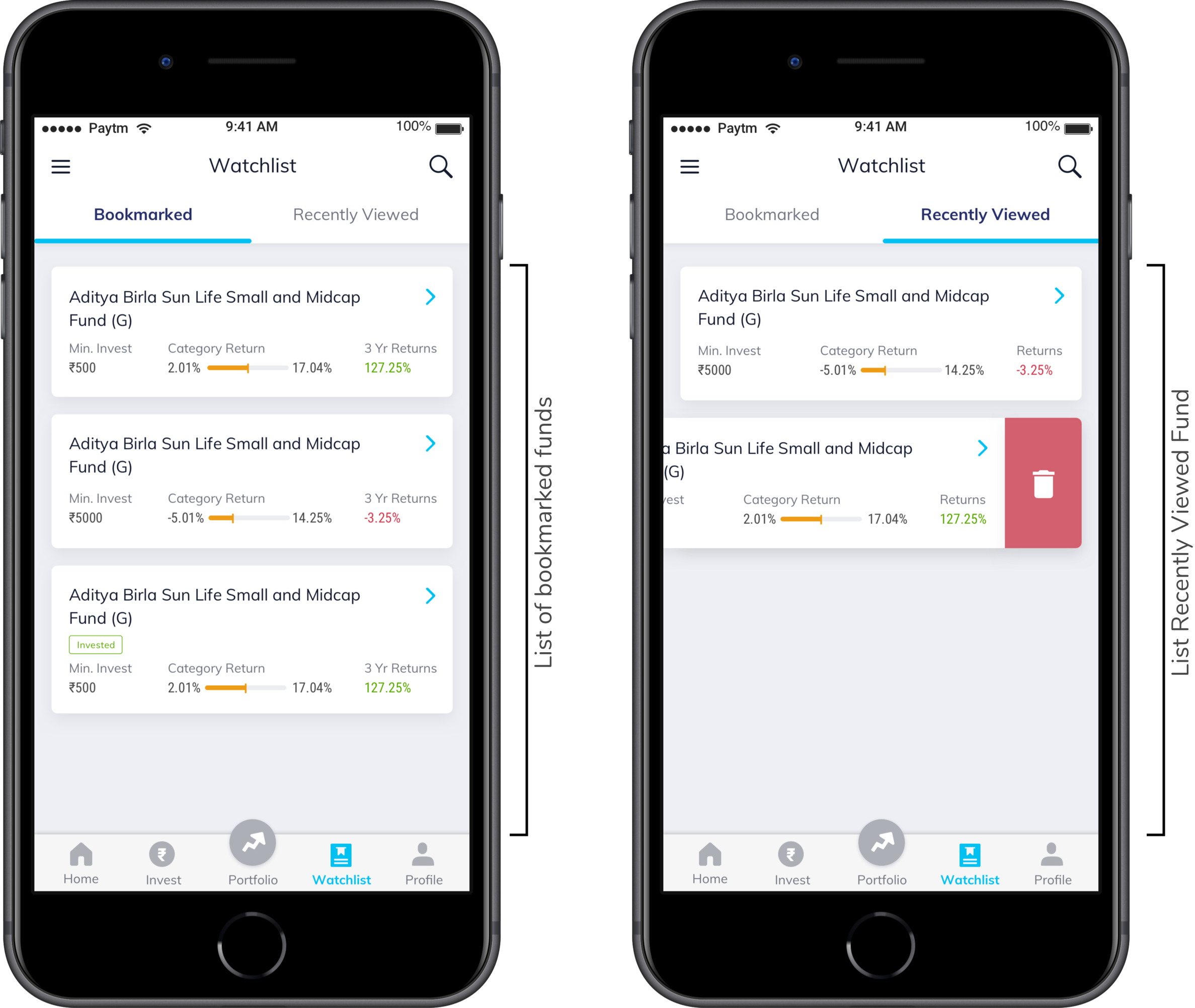

Wishlist

Wishlist was added because users usually open and check some fund performance while doing some self research and then forget the names of funds seen or shortlisted, this feature would solve that problem as we also introduced a feature of Recently viewed and bookmarking the fund of interested.

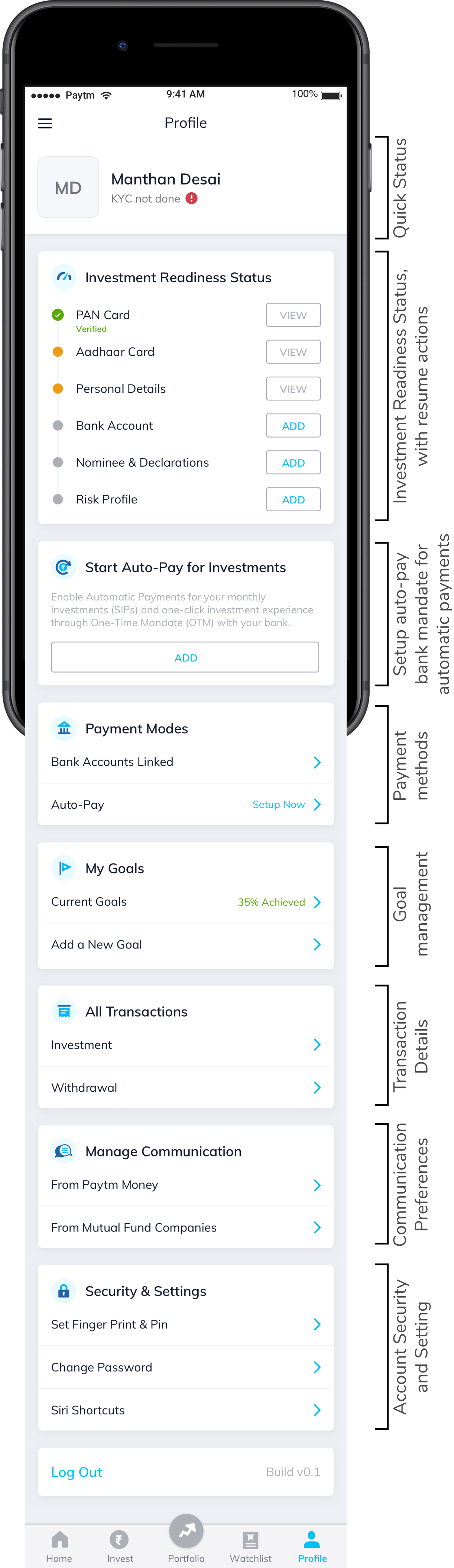

Profile

Profile or user management would be a quick access page for everything related to account or investment profile from Investment Readiness to Payment Methods, Goals, Transactions and Settings.

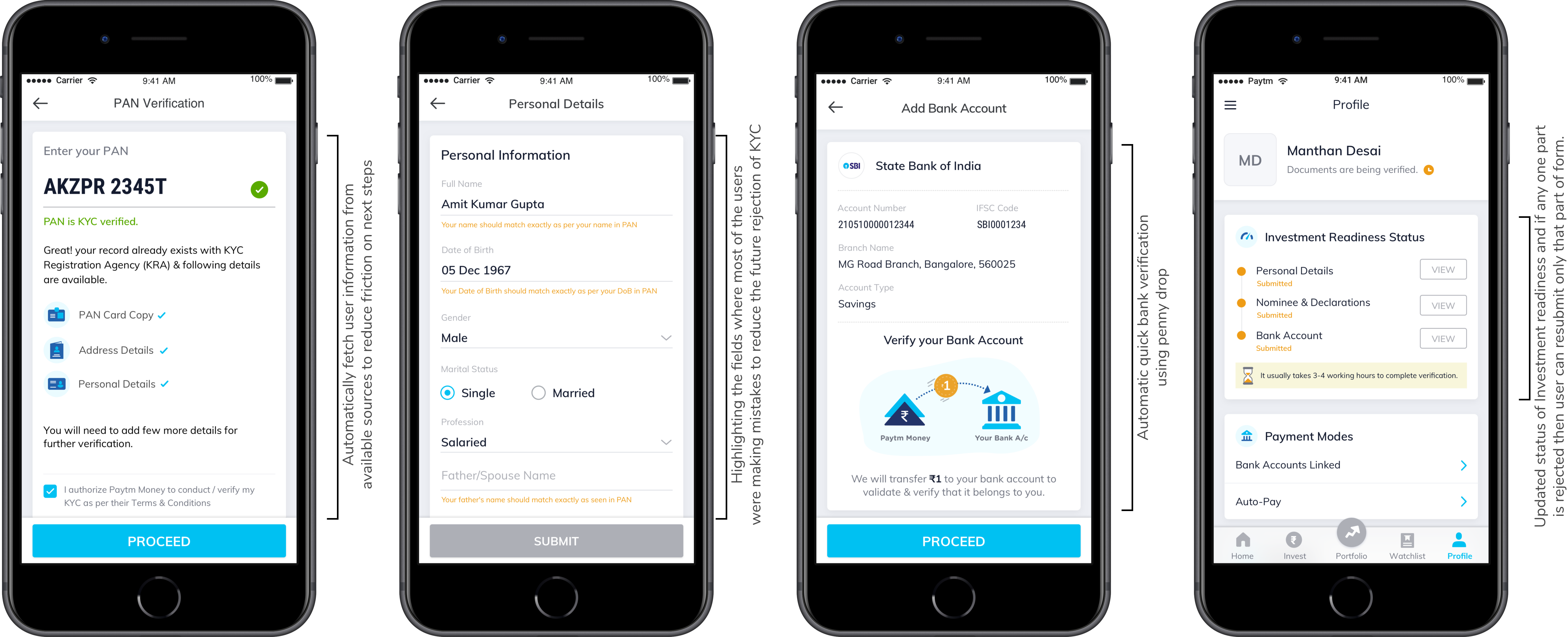

KYC Onboarding

This is the most tedious task that a user has to perform, specifically a new user who has never invested anywhere, to make things simpler we tried fetching user data from multiple sources and prefill the KYC form for user.

We also made sure that we reduce the friction in bank account verification of KYC process, so we introduced Penny drop to quickly verify bank account without much time taken.

Users were always kept updated with their Investment Readiness Card at multiple places in the app so that they can quickly finish their KYC and start investing.

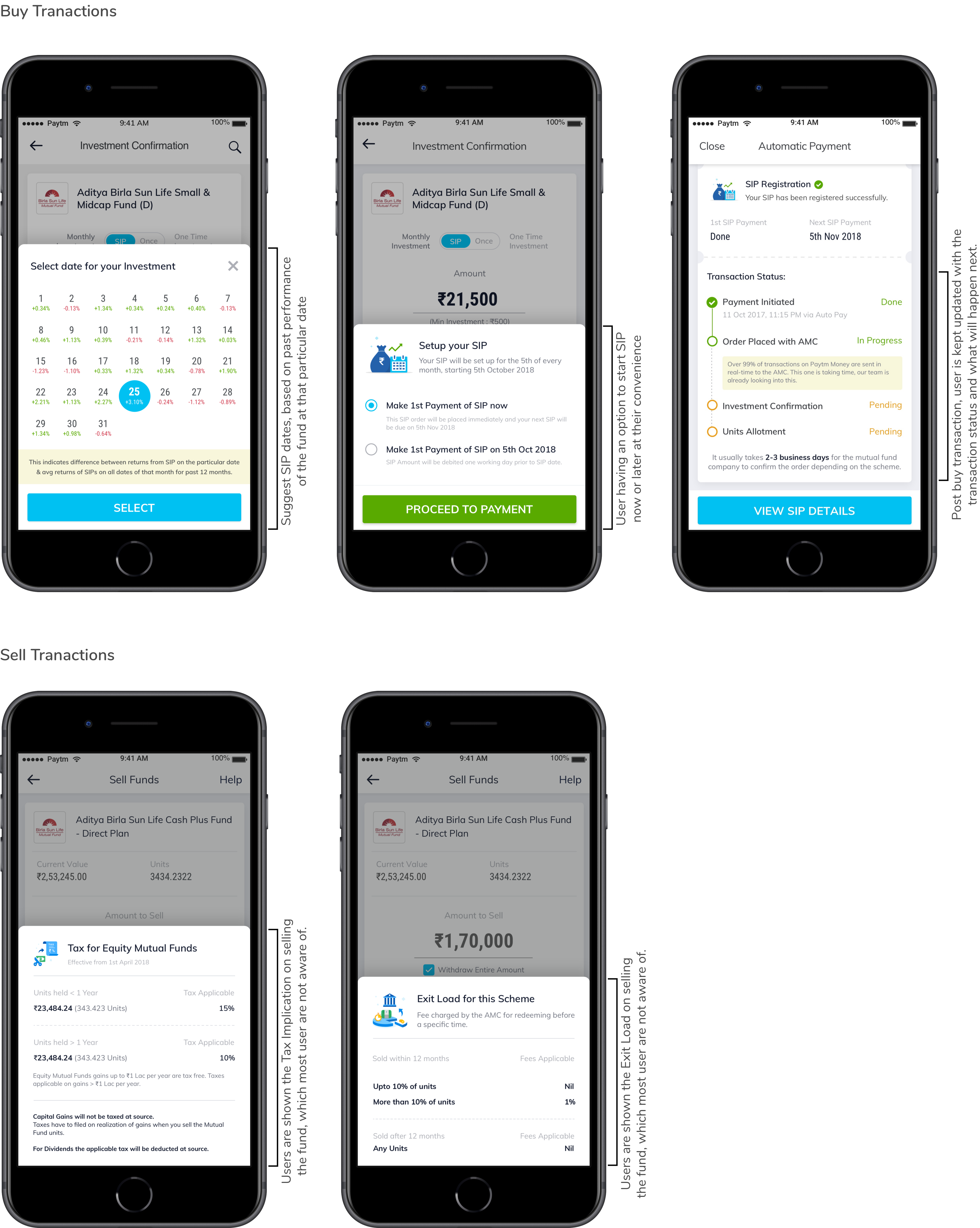

Buy/Sell of Mutual Funds

This is the part where users were not sure of SIP dates, Exit Load, Tax implications and overall transaction process, to keep the process transparent we added full process timeline, SIP date suggestion based on past performance of that fund on that specific date, Exit Load, Tax implications info while selling a fund which helped us in maintaining a transparent transaction with users.

The Launch

We launched with a waiting list to reduce the number of KYC verification per day as we had a limited number of team members in our KYC Ops team.